GOTW | Xero Tip: PAYE Returns

"Tips on PAYE return setup and processing...""

Filing PAYE returns using Xero is quite a process currently, compared with GST returns that we talked about in previous weeks. Right now, there isn’t a secure portal like the GST returns with IRD to have the ability to push PAYE returns through in the same easy way. The good news is this is coming in the near future. For now, here is some useful information to help you file PAYE returns using Xero and your myIR account.

Once you have processed all of the relevant pay runs for the month in Xero, you are ready to file the PAYE return.

Step 1: PAYE return is created in Xero

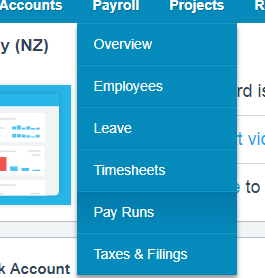

1. Go to Payroll

2. Select Taxes & Filings

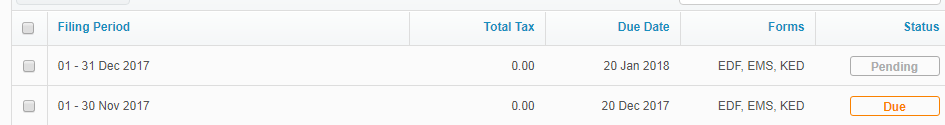

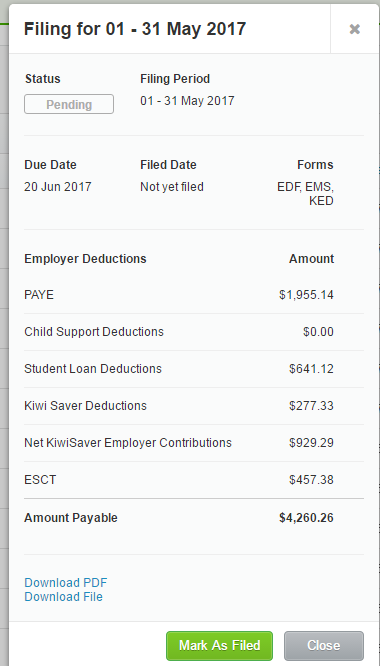

3. Select the relevant filing period from the list. The status column will show if the return is overdue, due or pending. Once you have filed the first pay run for the month, the status will show as pending until the end of the month has passed

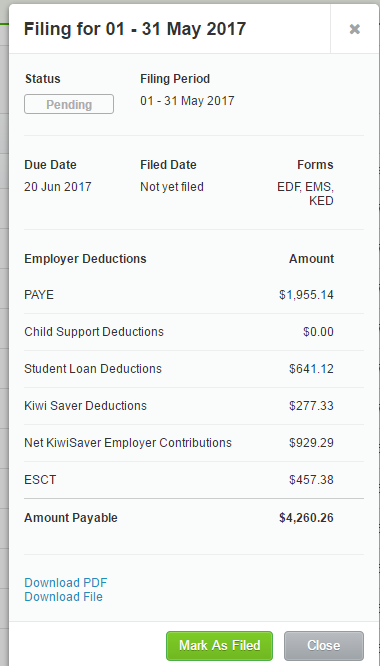

4. The details box will appear, showing details of the PAYE return that is being created

5. Select Download PDF to view what the filing report will look like and to keep for your records

6.Select Download File. This is a .zip file that contains files that will be uploaded to the IRD to file your PAYE return. Save this folder in a relevant area on your computer

Step 2: File PAYE return using myIR

1. Log into your myIR account

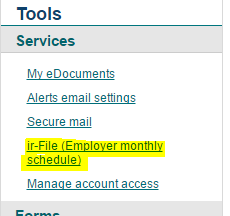

2. On the right-hand side under Tools select ir-File (Employer Monthly Schedule)

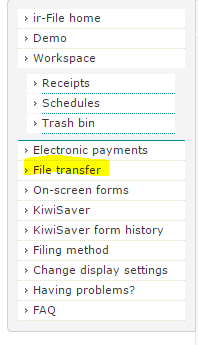

3. On the new screen select Filing Method

4. Select File monthly using payroll transfer file (this will only have to be completed once)

5. Select Update

6. On the left-hand side of the screen select File Transfer

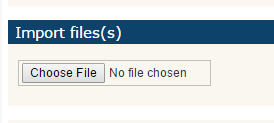

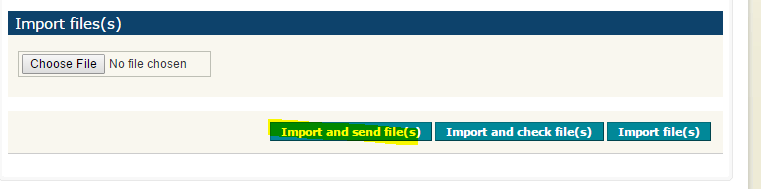

7. Select Choose File

8. Navigate to the .zip folder that you saved in Step 1 and add each file individually. There will be three files types. .edf, .ems, and .ked. These are the individual tax types

9. When each file has been added select Import and send file(s)

10. A message will display that the file transfer was successful

11. Repeat steps 1 - 9 again for the remaining two files

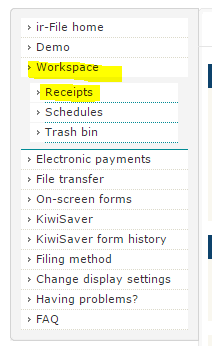

12. Once all files have been transferred on the left-hand side of the screen select Receipts under the Workspace heading

13. This page confirms that each return file has been filed with IRD. You can print off or save the receipts confirming that the returns have been filed

14. On the left-hand side of the screen select Electronic payments

15. This will provide you with information on how to make these payments electronically to IRD

Step 3: Mark PAYE return as Filed in Xero

1. Go back to Xero and select the Mark As Filed field as below

If you need any assistance with the PAYE Return process in Xero or have any further questions….

Please contact our in-house guru, Kate

http://www.bwr.co.nz/contact-us#itdept

06 873 8037