GOTW | Xero Tip: Bank Reconciliations

"Common errors during the bank reconciliation process and how to fix them..."

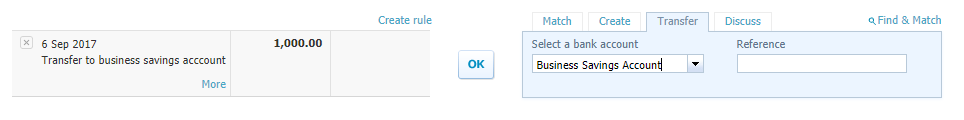

The transfer tab… used for transfers between bank accounts

Using this option incorrectly causes the bank accounts to become out of balance.

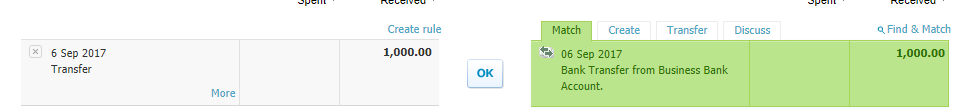

You only need to code a transfer in one bank account (e.g. bank account number 1). For example, if bank account number 1 transferred $1,000 to bank account number 2, in bank account number 1 reconcile the $1,000 withdrawal using the transfer tab.

Xero will automatically create the corresponding entry in the other bank account (bank account number 2). You just need to go into the other bank account (bank account number 2) and match it....

GEEK TIP 1: Code the transfers in one bank account and then immediately go into the other bank account and match them. Don’t worry about coding other transactions.

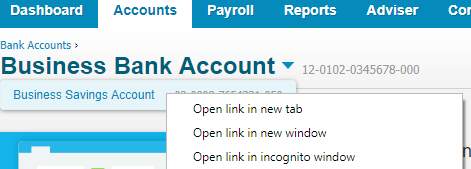

GEEK TIP 2: To make the reconciliation process easier, have each bank account opened in a separate tab. This will make identifying and reconciling the transfers quick and easy. Code the first transfer and then go to the new tab to match the transfer (note you will need to refresh your page in the separate tab to show the transfer match.)

GEEK TIP 3: To open another tab in Xero on any screen, either:

- Right-click on what you want to open and select Open link in new tab

- If you have a scroll wheel on your mouse, use that to click on what you want to open, or

- On your keyboard, hold down the CTRL key down as you click (or Command on a Mac) - you’ll find another tab opens.

The transfer tab... matching the wrong transfer

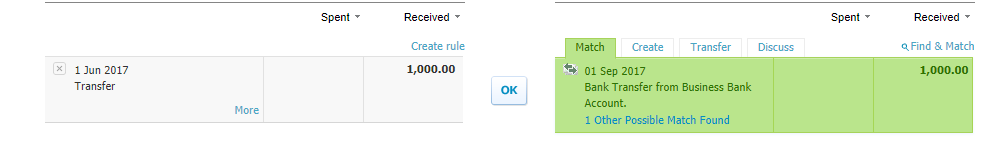

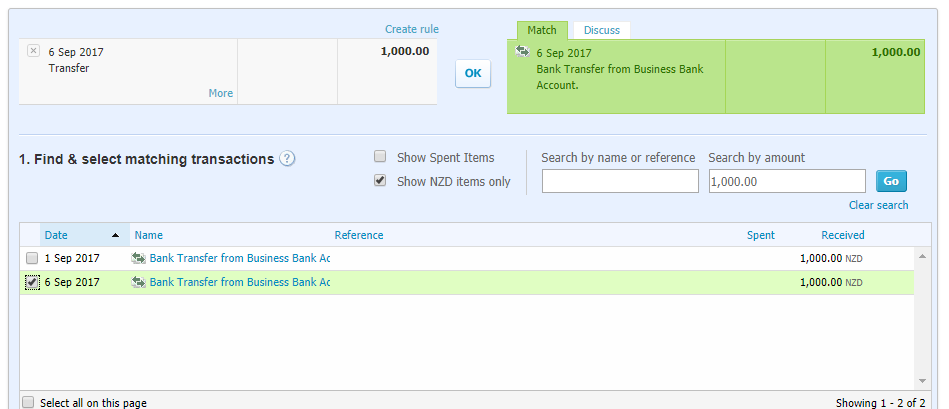

If you do happen to match the above transfer incorrectly it can also cause the bank balances to be incorrect. As Xero matches transfers based on amount rather than date it can be easy to match the wrong transfer. This is common if you have regular transfers between bank accounts of the same amount on different dates. Once you incorrectly match a transfer on the wrong date, then Xero will continually match the transfers incorrectly and the issue will continue to grow. Therefore, it is important to take care during the reconciliation process.

GEEK TIP 4: Always check the dates are the same before hitting OK on the suggested match. If Xero has matched the date incorrectly there may be another match that it can be changed to. It will show as 1 Other Possible Match Found.

Click on this link and it will show a list of potential other matches. Select the correct transfer date and click OK to reconcile...

GEEK TIP 5: If you match the incorrect transfer in error, the great news is this can be fixed:

-

- Make a note of the date and amount of the incorrect transfer

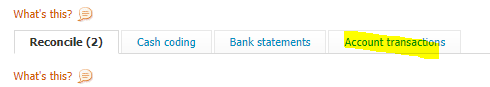

- Select the Account Transactions tab

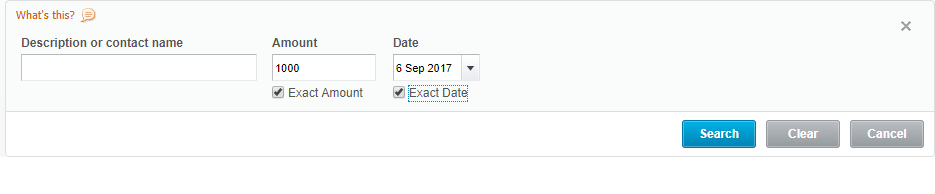

- Click on the Search button

- Search for the exact Amount and exact Date

- Click Search

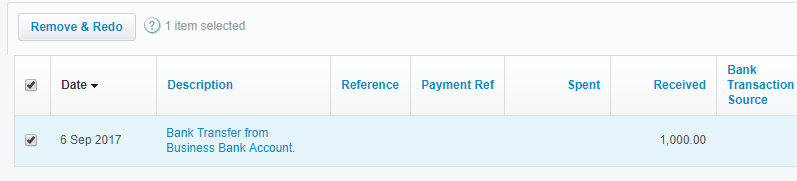

- The incorrect transfer transaction will show

- Select Remove & Redo

- This will make the whole transfer change to un-coded and go back in the other bank account as unreconciled so it can be matched correctly. This resets the incorrect transaction.

-

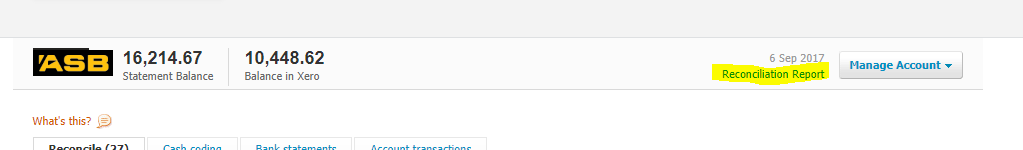

GEEK TIP 6: Run the Reconciliation Report regularly to ensure the Xero calculated bank balances matches with the Bank Statement....

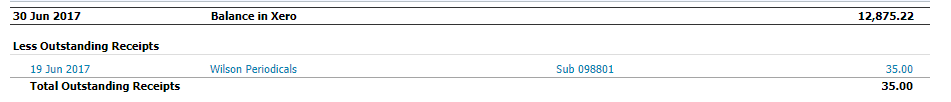

If your bank accounts have been reconciled correctly, there should be no transactions listed in the report. The Balance in Xero and the Statement Balance should match exactly...

The Reconciliation Report... most common causes for “Out of Balance” errors

1. Unreconciled Statement Lines - these are transactions that are unreconciled in the Reconcile screen that are not yet allocated or matched.

GEEK TIP 7: It is best to reconcile all transactions in the Reconcile screen before running the Reconciliation Report

2. Outstanding Receipts/Payments - these are Receive/Spend Money transactions that have been entered into Xero manually that have not been matched off against bank feeds. Common causes are...

- Original bank statement line has been coded rather than matched to the Receive/Spend Money transaction created. Either Xero hasn’t suggested a match or the user overrides the match and codes it directly. This in turns creates a new Receive/Spend Money entry which is a duplicate of the one already created.

GEEK TIP 8: To fix duplicate Spend/Receive Money entries...

-

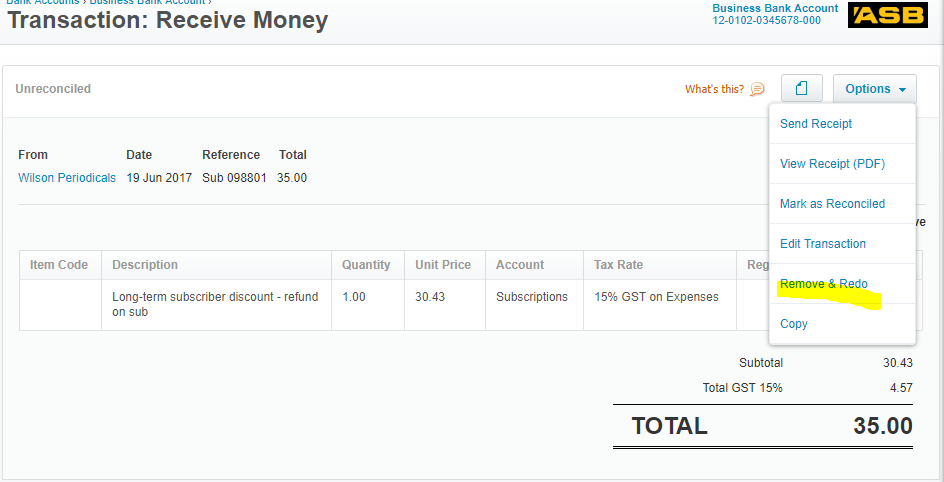

- Click on the outstanding Receipt/Payments line on the Reconciliation Report

- This opens the transaction up in a new screen. As it is a duplicate entry Remove & Redo will solve it

- Select Options, Remove & Redo - as this was a manual entry the duplicate will completely disappear from Xero

The Receive/Spend Money transactions was created against the wrong bank account. This again can be fixed by using the Remove & Redo option from Geek Tip 8

3. Balance out by. This is a lot trickier to ascertain why there is an out of balance amount showing here. It would be recommended to have an expert eye look into this. This could be caused by a number of issues:

-

- Incorrect conversion balanced entered at start-up. When setting up your Xero ledger for the first time, it prompts you to enter the opening bank balance as at the conversion date. If this is entered incorrectly or not at all, this will cause the bank account to be out of balance in Xero

- Manually Reconciled Transactions. This is quite rare, but can happen if the Mark as Reconciled option is used. This option should never be used when you have automatic bank feeds setup in Xero. All of the reconciliations should happen in the Reconcile screen.

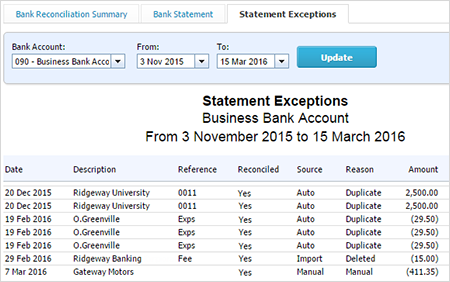

GEEK TIP 9: Manually reconciliation transactions can be identified using the Statement Exceptions tab on the Reconciliation Report. These will need to be investigated further to determine whether these entries were valid or not. Using the Remove & Redo fix from Geek Tip 8 will solve these incorrect entries that have been Marked as Reconciled

-

- Duplicate Bank Statement Lines. This again is quite rare now in Xero as they use Direct Feeds, so the transactions coming from the bank statements are more accurate. Xero does attempt to recognise duplicate entries by showing them in the Statement Exceptions tab in the Reconciliation Report. These incorrect entries can be again solved by using Geek Tip 8 to Remove & Redo

- Missing Bank Statement Lines this occurs when the automatic bank feeds are started and there is a gap of missing transactions between the conversion date and the date the first automatic bank transaction starts in Xero. This is resolved by manually exporting missing transactions from your online banking account and sending them to an expert to convert into Xero format ready to import into Xero

- Deleted Bank Statement Lines it is easy to be able to delete a bank statement line from the reconcile screen which in turn causes the bank balance in Xero to become out of balance. Again, the easiest way to see if this has happened is looking at the Statement Exceptions tab of the Reconciliation Report. The good news is, deleted bank statement lines can be restored!

The only time it is okay to delete a bank statement line is if it is a duplicate entry that has come from the bank or the transaction has been manually imported twice in error.

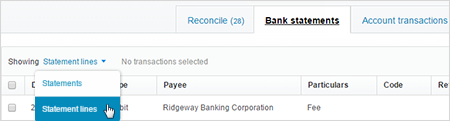

GEEK TIP 10: To restore a bank statement line:

-

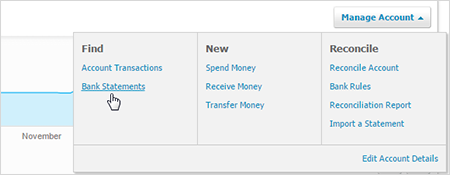

- Select the Accounts menu, then click Bank Accounts

- Find the bank account that you want to restore the bank statement line to

- Click Manage Account and select Bank Statements

- Click showing Statement lines from the drop-down menu

- Select the checkbox next to the statement line you want to restore (note the Status Column will show that the bank statement line has been deleted)

- Click Restore

If you need any assistance with the bank reconciliation process in Xero or have any further questions, please

contact our in-house guru Kate

- Click on the outstanding Receipt/Payments line on the Reconciliation Report

-